Get the free cba lease form

Show details

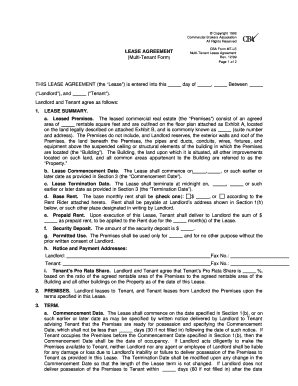

Commercial Brokers Association ALL RIGHTS RESERVED CBA Form ST-NNN Single Tenant NNN Lease Rev. 3/2011 Page 1 of 20 LEASE AGREEMENT Single Tenant for Entire Parcel - NNN THIS LEASE AGREEMENT the Lease is entered into and effective as of between and Landlord and Tenant agree as follows date Landlord Tenant.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cba lease form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cba lease form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cba lease online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cba wa form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out cba lease form

How to fill out cba lease:

01

Start by carefully reading the lease agreement document provided by the cba (Commercial Brokerage Association).

02

Pay close attention to all the terms, conditions, and clauses mentioned in the lease.

03

Gather all the necessary information and documentation required to complete the lease. This may include personal identification, financial statements, and references.

04

Begin filling out the lease agreement form provided. Make sure to enter all the required information accurately and clearly.

05

Follow any specific instructions provided in the lease, such as initialing certain sections or signing in the presence of a witness.

06

Double-check all the information you have entered to ensure its accuracy. Errors or omissions could lead to legal issues or complications in the future.

07

If you have any questions or concerns, don't hesitate to reach out to the cba or seek legal advice before signing the lease agreement.

08

Once you have completed filling out the lease agreement, review it one last time to ensure everything is in order. Sign the document as required and keep a copy for your records.

Who needs cba lease:

01

Individuals or businesses who are looking to lease commercial property.

02

Property owners or landlords who wish to legally lease out their commercial spaces.

03

Real estate agents or brokers who assist in the leasing process and require a standardized lease agreement from the Commercial Brokerage Association (cba).

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cba lease?

CBA Lease refers to a lease agreement provided by Commonwealth Bank of Australia (CBA), one of the largest banks in Australia. CBA Lease offers a financing solution for businesses and individuals to lease various types of assets, such as vehicles, equipment, and machinery, without the need for upfront payments. The lessee (the customer) makes regular repayments to CBA over a specified period, usually ranging from one to seven years, in exchange for the use of the leased asset. At the end of the lease term, the lessee usually has the option to purchase the asset, return it, or enter into a new lease agreement. The terms and conditions of CBA Lease may vary depending on the specific arrangement and agreement between the bank and the customer.

Who is required to file cba lease?

The term "CBA lease" is not commonly used and may refer to a specific type of lease agreement or contract that is relevant in a specific context or jurisdiction. Without more information, it is difficult to determine who is specifically required to file such a lease.

Typically, both parties involved in a lease agreement, namely the landlord (lessor) and the tenant (lessee), may be required to file certain documentation related to the lease with the appropriate authorities, such as local government departments, tax authorities, or regulatory bodies. However, the specific filing requirements may vary depending on the jurisdiction, type of property, and the nature of the lease.

To determine who is required to file a CBA lease in a specific situation, it is recommended to consult with a legal professional or research the specific laws and regulations applicable in the relevant jurisdiction.

How to fill out cba lease?

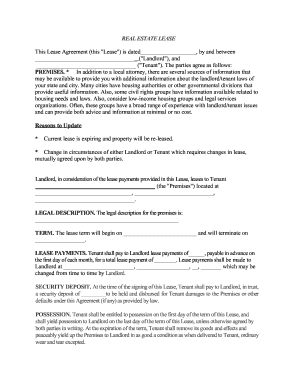

To fill out a CBA lease, follow these steps:

1. Read through the entire lease agreement carefully, understanding all the terms and conditions mentioned. Ensure that you agree to and can comply with the terms before proceeding.

2. Begin by entering the full legal names of all the parties involved, including the landlord (i.e., the lessor) and the tenant (i.e., the lessee). Include their addresses and any additional contact information required.

3. Specify the property details, such as the complete address including unit number, city, state, and zip code. Also, provide a brief description of the property, including any special features, facilities, or amenities.

4. Indicate the lease term, including the start and end dates. If it is a fixed-term lease, clearly state the duration (e.g., 1 year, 2 years, etc.). If it is a month-to-month or periodic lease, mention the agreed notice period for termination.

5. Specify the rental amount and when it is due. Include any late fees/penalties for delayed payments and the preferred method of payment (e.g., check, online transfer). If there are any discounts, promotional offers, or agreed-upon increases during the lease period, mention them as well.

6. Include the security deposit amount, the method of payment, and conditions for its return at the end of the lease term. Outline any deductions that may be made from the security deposit for damages and when it will be refunded.

7. Clearly state the responsibilities of both the landlord and tenant regarding maintenance and repairs. Include any specific obligations, such as the tenant's duty to take care of lawn maintenance, snow removal, or regular cleaning. Specify whether the tenant is allowed to make alterations or modifications to the property.

8. Mention any utilities or services that are included in the rent, such as water, electricity, gas, cable, internet, or garbage disposal. If the tenant is responsible for any utility payments, provide details on how they should be paid and if there are any limits or caps.

9. Include rules and regulations for the property, such as restrictions on pets, smoking, noise levels, or subletting. Also, mention any specific policies regarding proper use of common areas, parking spaces, or storage facilities.

10. Add any additional clauses or provisions that you and the landlord agree upon, such as renewal options, special agreements, or any specific requirements either party has. Ensure that both parties fully understand and agree to these additional terms.

11. Review the lease agreement thoroughly before signing it. Make sure that you haven't missed any important details or left any sections blank. Seek legal advice if needed, especially for complex lease agreements.

12. Sign the lease agreement along with the landlord, and ensure that all necessary copies are made. It is advisable to keep a copy for your records, either in physical or digital form.

Remember, leasing agreements are legally binding documents, so it's important to carefully review and understand all the terms before signing to avoid any future disputes.

What is the purpose of cba lease?

CBA Lease, also known as a Commercial Bank of Africa Lease, is a financing solution provided by the Commercial Bank of Africa (CBA) in Kenya. The purpose of CBA Lease is to offer businesses a convenient way to acquire assets such as equipment, machinery, vehicles, and real estate without having to pay the full purchase price upfront.

The main purpose of CBA Lease is to provide businesses with an alternative to purchasing assets outright, as it allows them to conserve their working capital and allocate it to other business needs. Instead of purchasing the asset, the business leases it from the bank for a specified period, paying regular lease payments in return. This helps businesses avoid the burden of large capital expenditures and enables them to spread the cost of acquiring assets over time.

CBA Lease also provides businesses with flexibility, as the lease terms can be tailored to the specific needs and cash flow of the organization. At the end of the lease term, businesses have the option to either return the asset, extend the lease, or even purchase the asset at a predetermined price.

Overall, the purpose of CBA Lease is to support businesses in acquiring necessary assets while minimizing the financial strain and providing flexibility in managing their cash flow.

What information must be reported on cba lease?

When reporting on a Commercial Building Agreement (CBA) lease, the following information should be provided:

1. Parties involved: Names, addresses, and contact information of the lessor (building owner) and lessee (tenant).

2. Lease term: Start and end dates of the lease agreement.

3. Rent and payment terms: Details about the base rent amount, any additional charges (such as utilities or maintenance fees), and the frequency and method of payment.

4. Security deposit: Amount and terms of any security deposit paid by the tenant.

5. Premises description: Description of the leased premises, including the address, size, and allocation of space (if applicable).

6. Permitted use and restrictions: Stipulations on the allowed use of the premises and any restrictions or conditions imposed by the lessor.

7. Maintenance and repairs: Explanation of the parties' responsibilities regarding maintenance and repairs of the premises.

8. Insurance requirements: Details about the insurance coverage required by the lessor and/or lessee, including liability, property, and any other specific insurances.

9. Lease termination: Conditions and procedures for early termination of the lease agreement, including notice periods and any associated penalties.

10. Renewal options: Any provisions for extending or renewing the lease agreement.

11. Indemnification and liability: Clauses addressing the liability of both parties and the lessee's obligation to indemnify the lessor against any claims, damages, or losses.

12. Default and remedies: Explanation of the consequences of default by either party and the available remedies, such as termination or eviction.

13. Governing law: Indication of the jurisdiction and legal framework that governs the lease agreement.

It is important to note that specific requirements for reporting on a CBA lease may vary depending on the industry, jurisdiction, and the terms negotiated between the parties. Consulting legal professionals and relevant regulations is advisable to ensure compliance.

What is the penalty for the late filing of cba lease?

The specific penalty for late filing of a CBA (Collective Bargaining Agreement) lease can vary depending on the jurisdiction and the specific terms outlined in the agreement. It is recommended to consult the relevant labor laws and regulations in your specific country or state to determine the penalties for late filing. Typically, the penalties may include fines, additional fees, or potential legal repercussions.

How can I send cba lease to be eSigned by others?

Once you are ready to share your cba wa form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my cba nnn lease wa word in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your cba lease directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit cba lease on an iOS device?

Create, edit, and share cba lease form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your cba lease form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cba Nnn Lease Wa Word is not the form you're looking for?Search for another form here.

Keywords relevant to cba lease agreement form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.